Reporting

Responsibility for external financial reporting

Management’s responsibility

Management’s report regarding the effectiveness of internal controls over external financial reporting

The management of the European Bank for Reconstruction and Development (the Bank) is responsible for the preparation, integrity, and fair presentation of its published financial statements and associated disclosures presented in this Financial Report 2018. The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

The financial statements have been audited by an independent accounting firm, which has been given unrestricted access to all financial records and related data, including minutes of all meetings of the Board of Directors and committees of the Board. Management believes that all representations made to the external auditor during its audit were valid and appropriate. The external auditor’s report accompanies the audited financial statements.

Management is responsible for establishing and maintaining effective internal control over external financial reporting for financial presentation and measurement in conformity with IFRS. The system of internal control contains monitoring mechanisms, and actions are taken to correct deficiencies identified. Management believes that internal controls for external financial reporting – which are subject to scrutiny and testing by management and are revised, as considered necessary, taking account of any related internal audit recommendations – support the integrity and reliability of the financial statements.

There are inherent limitations in the effectiveness of any system of internal control, including the possibility of human error and the circumvention of overriding controls. Accordingly, even an effective internal control system can provide only reasonable assurance with respect to financial statements. Furthermore, the effectiveness of an internal control system can change with circumstances.

The Bank’s Board of Directors has appointed an Audit Committee, which assists the Board in its responsibility to ensure the soundness of the Bank’s accounting practices and the effective implementation of the internal controls that management has established relating to finance and accounting matters. The Audit Committee is comprised entirely of members of the Board of Directors. The Audit Committee meets periodically with management in order to review and monitor the financial, accounting and auditing procedures of the Bank and related financial reports. The external auditor and the internal auditor regularly meet with the Audit Committee, with and without other members of management being present, to discuss the adequacy of internal controls over financial reporting and any other matters that they believe should be brought to the attention of the Audit Committee.

The Bank has assessed its internal controls over external financial reporting for 2018. Management’s assessment includes the Special Funds and other fund agreements referred to in notes 30 and 31 of the Financial Report 2018, and the retirement plans. However, the nature of the assessment is restricted to the controls over the reporting and disclosure of these funds/plans within the Bank’s financial statements, rather than the operational, accounting and administration controls in place for each fund.

The Bank’s assessment was based on the criteria for effective internal controls over financial reporting described in the “Internal Control – Integrated Framework” issued by the Committee of Sponsoring Organisations of the Treadway Commission (2013 framework). Based upon this assessment, management asserts that at 31 December 2018 the Bank maintained effective internal controls over its financial reporting as contained in the Financial Report 2018.

The Bank’s external auditor has provided an audit opinion on the fair presentation of the financial statements presented within the Financial Report 2018. In addition, it has issued an attestation report on management’s assessment of the Bank’s internal control over financial reporting, as set out below.

Suma Chakrabarti

President

European Bank for Reconstruction and Development

London

27 March 2019

András Simor

Senior Vice President, Chief Financial Officer and Chief Operating Officer

Report of the independent auditor

To the Governors of the European Bank for Reconstruction and Development

We have examined management’s assessment that the European Bank for Reconstruction and Development (the Bank) maintained effective internal controls over financial reporting as contained in the Bank’s Financial Report 2018, based on the criteria for effective internal controls over financial reporting described in the “Internal Control – Integrated Framework” issued by the Committee of Sponsoring Organisations of the Treadway Commission (2013 framework). Management is responsible for maintaining effective internal controls over financial reporting and for the assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on management’s assertion over the effectiveness of the Bank’s internal control over financial reporting, based on our examination.

We conducted our examination in accordance with the International Standard on Assurance Engagements (ISAE) 3000. Our examination included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment and performing such other procedures as we considered necessary in the circumstances. We believe that our work provides a reasonable basis for our opinion.

A bank’s internal controls over financial reporting are designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A bank’s internal controls over financial reporting include those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the bank; (2) provide reasonable assurance that the transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the bank are being made only in accordance with the authorisation of the bank’s management; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorised acquisition, use, or disposition of the bank’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies and procedures may deteriorate.

In our opinion, management’s assertion that the Bank maintained effective internal control over financial reporting, included within the “Responsibility for external financial reporting” section of the Bank’s Financial Report 2018 is fairly stated, in all material respects, based on the criteria for effective internal controls over financial reporting described in the “Internal Control – Integrated Framework” issued by the Committee of Sponsoring Organisations of the Treadway Commission (2013 framework).

This report, including the opinion, has been prepared for, and only for, the Board of Governors as a body in connection with management’s attestation for maintaining effective internal controls over financial reporting and for no other purpose.

We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come, save where expressly agreed by our prior consent in writing.

Deloitte LLP

Chartered Accountants

London, United Kingdom

27 March 2019

Independent auditor’s report to the Governors of the European Bank for Reconstruction and Development

Report on the audit of the financial statements

Opinion

In our opinion the financial statements of the European Bank for Reconstruction and Development (the Bank):

- give a true and fair view of the state of the Bank’s affairs as at 31 December 2018 and of its profit for the year then ended

- have been properly prepared in accordance with International Financial Reporting Standards (IFRSs) as issued by the International Accounting Standards Board (IASB).

We have audited the financial statements of the Bank, which comprise:

- the income statement

- the statement of comprehensive income

- the balance sheet

- the statement of changes in equity

- the statement of cash flows

- the statement of accounting policies

- the risk management disclosures

- the related notes 1 to 32.

The financial reporting framework that has been applied in their preparation is applicable law and IFRSs as adopted by the IASB.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs) and applicable law. Our responsibilities under those standards are further described in the auditor’s responsibilities for the audit of the financial statements section of our report.

We are independent of the Bank in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code) together with the ethical requirements that are relevant to our audit of the financial statements in the United Kingdom, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Summary of our audit approach

| Key audit matters | The key audit matters that we identified in the current year were: · valuation of illiquid equity investments and associated derivatives · loan impairment and provisioning. Within this report, any new key audit matters are identified with ↑ and any key audit matters which are the same as the prior year identified with ↔. |

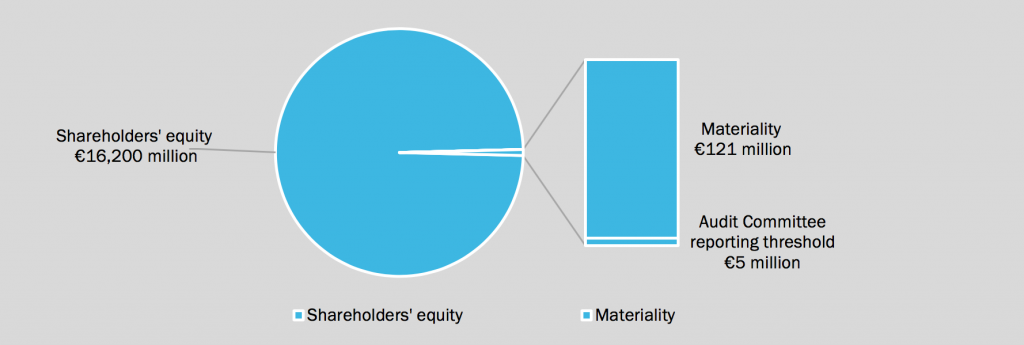

| Materiality | The materiality that we used in the current year was €121 million which was determined on the basis of 0.75 per cent of shareholders’ equity of €16.2 billion as disclosed in the balance sheet and statement of changes in equity. |

| Scoping | Our audit was performed on the Bank’s legal entity. Audit work to respond to the risks of material misstatement was performed directly by the audit engagement team. |

| Significant changes in our approach | During the current period, we determined that as there was no change in accounting policy during the year that commitment fees were no longer a key audit matter. |

| Materiality | The materiality that we used in the current year was €121 million which was determined on the basis of 0.75 per cent of shareholders’ equity of €16.2 billion as disclosed in the balance sheet and statement of changes in equity. |

| Scoping | Our audit was performed on the Bank’s legal entity. Audit work to respond to the risks of material misstatement was performed directly by the audit engagement team. |

| Significant changes in our approach | During the current period, we determined that as there was no change in accounting policy during the year that commitment fees were no longer a key audit matter. |

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements of the current period and include the most significant assessed risks of material misstatement (whether due to fraud or not) that we identified. These matters included those which had the greatest effect on: the overall audit strategy; the allocation of resources in the audit; and directing the efforts of the engagement team.

These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

| Valuation of illiquid equity investments and associated derivatives | |

| Key audit matter description ↔ | The valuation of illiquid equities within “share investments” (December 2018: €3.2 billion; December 2017: €3.3 billion) and associated level 3 derivatives (December 2018: €400 million; December 2017: €385 million) is a key audit matter given the large size of the portfolio and the inherent subjectivity when determining fair values. In general there is a lack of comparable market transactions in the economies where the Bank operates leading to difficulties in deriving fair values for illiquid equity investments. Additionally, the Bank enters into option transactions in order to facilitate an exit route for certain equity investments. The valuations of the associated derivatives are complex as they relate to subjective variables such as the valuation of the underlying equity and the time value to the option exercise date. The fair value of both the illiquid equity investments and associated derivatives can therefore fall within a relatively wide valuation range. Due to the high level of judgements involved, we have determined that there was a potential for fraud through possible manipulation of this balance. Management have assessed the sensitivity of the portfolio by considering reasonably possible alternative assumptions (such as multiples) in the individual equity valuations as disclosed within Risk Management Note F in the financial statements. The relevant accounting policy is disclosed in Note B, and further details in Note 5, Note 14 and Note 18 to the financial statements. |

| How the scope of our audit responded to the key audit matter | We completed the following procedures in relation to the valuation of illiquid equity investments and associated derivatives: · We tested management controls in place over the valuation process for illiquid equity investments and associated derivatives. This involved gaining an understanding of the Bank’s valuation methodology and the processes and procedures to ensure this methodology is consistently applied over the portfolio with appropriate management review and challenge. · We tested a sample of illiquid equity investments and associated derivatives to assess the appropriateness of the valuations applied by the Bank. Our work has involved testing and challenging the inputs and assumptions used in the methodologies adopted. This has included: o assessing the appropriateness of the methodology used – the Bank adopts a number of methodologies to estimate fair value including the use of earnings multiples, net asset values or discounted cash flows and we have assessed the appropriateness of the methodology choice made for each investment taking into account the nature of the investment being valued o assessing the appropriateness of inputs and assumptions – within each methodology, there are a number of inputs and assumptions. We have tested factual inputs (for example, earnings, comparable company multiples) to source information and assessed the appropriateness of any assumptions (for example, the choice of comparable companies, the level of liquidity discounts) applied to arrive at the final valuation. · We have performed retrospective testing at the portfolio level to consider the reasonableness of the Bank’s valuations in light of exit proceeds received during the year. · We considered the frequency of historic trading of listed equities and assessed whether these investments had been appropriately classified as liquid or illiquid. · We reviewed publicly available information in relation to the Bank as well as Bank Committee minutes for indications of exits or disbursements around year end. |

| Key observations | We conclude that the valuation of illiquid equities and associated derivatives is reasonable and within the acceptable range of possible outcomes. |

| Loan impairment and provisioning: stage classification and specific provisions | |

| Key audit matter description ↔ | The Bank has implemented the new IFRS 9 impairment standard in the financial statements for the year ended 31 December 2018. The total provision balance for December 2018 is €981 million (December 2017: €850 million). Specific provisions comprise the majority of the loan loss provisions held by the Bank, being €675 million of the total €981 million provision balance as at December 2018 (December 2017: €602 million of a total €850 million). These constitute impaired loans within Stage 3 and represent loans in the portfolio where there is objective evidence of impairment. Key judgements and estimates in respect of the measurement and the timing of expected credit losses include the allocation of assets to Stage 1, 2 or 3 using criteria in accordance with the accounting standard. In addition, the key judgement within Stage 3 loans is the measurement of individually assessed provisions where impairments are inaccurately calculated due to incorrect assumptions being applied to model future cash flows. Due to the judgement involved in identifying and assessing the occurrence of a default event, as defined, there is management judgement involved in identifying impaired loans on a timely basis. Management have assessed the sensitivity of the portfolio provisions by considering reasonably possible alternative inputs into the provision calculation (such as probability of default ratings) in the individual loans as disclosed within “Critical accounting estimates and judgements”, Note C. |

| How the scope of our audit responded to the key audit matter | We completed the following procedures in relation to the loan impairment and provisioning balances: · As IFRS 9 was implemented at the beginning of the year, we performed audit procedures on the opening balance on transition from IAS 39. · We have performed testing over management’s lending and loan loss provisioning business cycles and tested the key controls in each including testing the relevant IT systems. · We challenged each element of the new provisioning methodology and tested the appropriateness of the IFRS 9 provisioning policy against the requirements of the standard. · We reviewed a sample of loans classified in Stage 1 and 2 assessing the appropriateness of the classification by looking at borrower financials, economic conditions, risks that the borrower is exposed to and internal risk ratings, to ensure that significant increases in credit risk have been adequately captured where necessary. · We assessed the disclosures relating to provisions and adjustments made in the adoption of IFRS 9. In order to consider the appropriateness of the valuation of specific provisions we performed further procedures: · We assessed the design and implementation of controls in place over the credit assessment process for banking loans to ensure they have operated correctly throughout the period. · For a sample of specific provisions, we: o assessed the economic situation of the borrower against Stage 3 determinants outlined in IFRS 9. o challenged management on assumptions made in factors affecting the cash flow forecast for specific loans. This included checking the consistency of inputs used to determine whether they are appropriate. · We performed detailed testing through re-performing the individual net present value calculations associated with each specific provision tested and reconciling the inputs to supporting documentation. |

| Key observations | We concluded that the provision balance disclosed across all loans and including specific provisions was reasonable and in compliance with IFRS 9. |

Our application of materiality

We define materiality as the magnitude of misstatement in the financial statements that makes it probable that the economic decisions of a reasonably knowledgeable person would be changed or influenced. We use materiality both in planning the scope of our audit work and in evaluating the results of our work.

Based on our professional judgement, we determined materiality for the financial statements as a whole as follows:

| Materiality | €121 million (2017: €115 million) |

| Basis for determining materiality | The materiality was determined on the basis of 0.75 per cent (2017: 0.75 per cent) of shareholders’ equity of €16.2 billion (2017: €15.4 billion) as disclosed in the balance sheet and statement of changes in equity. |

| Rationale for the benchmark applied | Materiality has been based on shareholder equity given our assessment of this being the most stable metric, and the most applicable to the operation of the Bank. |

We agreed with the Audit Committee that we would report to the committee all audit differences in excess of €5 million (2017: €5 million), as well as differences below that threshold that, in our view, warranted reporting on qualitative grounds. We also reported to the Audit Committee on disclosure matters that we identified when assessing the overall presentation of the financial statements.

An overview of the scope of our audit

Our audit was scoped by obtaining an understanding of the Bank and its environment, including internal control, and assessing the risks of material misstatement. Our audit was performed on the Bank legal entity given there were no material consolidated entities as at 31 December 2018. Audit work to respond to the risks of material misstatement was performed directly by the audit engagement team.

Other information

The President is responsible for the other information. The other information comprises the highlights, financial results and additional reporting and disclosures sections of the Financial Report for the year ended 31 December 2018.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated.

If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in respect of these matters.

Responsibilities of the President for the financial statements

The President is responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the President determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the President is responsible for assessing the Bank’s ability to continue as a going concern, disclosing as applicable, matters related to going concern and using the going concern basis of accounting unless the President either intends to liquidate the Bank or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

- identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control

- obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Bank’s internal control

- evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the President

- conclude on the appropriateness of management’s use of the going-concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained to the date of our auditor’s report. However, future events or conditions may cause the Bank to cease to continue as a going concern

- evaluate the overall presentation, structure and content of the financial statements, include the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with the relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on other legal and regulatory requirements

Matters on which we are required to report by exception

We are required to report to you if, in our opinion:

- we have not received all the information and explanations we require for our audit

- adequate accounting records have not been kept

- the financial statements are not in agreement with the accounting records.

We have nothing to report to you in respect of these matters.

Audit tenure

Following the recommendation of the Audit Committee, we were appointed by the President on 31 May 2011 to audit the financial statements for the year ending 31 December 2011 and subsequent financial periods. The period of total uninterrupted engagement including previous renewals and reappointments of the firm is eight years, covering the years ending 31 December 2011 to 31 December 2018.

Consistency of the audit report with the additional report to the Audit Committee

Our audit opinion is consistent with the additional report to the Audit Committee we are required to provide in accordance with ISAs.

Use of our Report

This report is made solely to the Board of Governors, as a body, in accordance with Article 24 of the Agreement Establishing the Bank dated 29 May 1990. Our audit work has been undertaken so that we might state to the Board of Governors those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Bank and the Board of Governors as a body, for our audit work, for this report, or for the opinions we have formed.

Alan Chaudhuri

For and on behalf of Deloitte LLP

London, United Kingdom

27 March 2019